Beauty China (B15) - TA and its Study

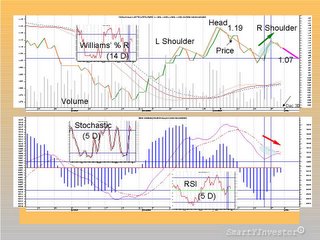

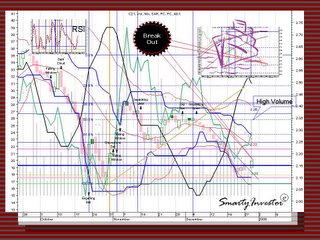

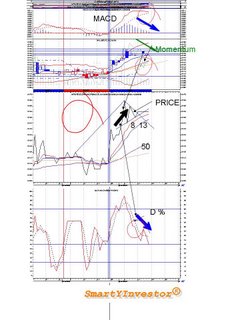

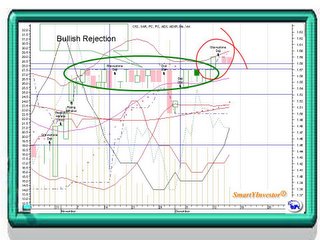

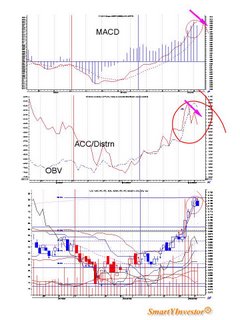

Not all Breakouts have got trendy potential. As in sailing, it is important to know which way the wind blows (in trading we mean trending direction and its sustainability) and at what speed (Trend strength). Beauty China Chart (2) shows 2 distinctive patterns: Simultaneously, a Descending Triangle and a Double Bottom within the Triangle. We shall down play RSI and Stochastic as they are most effective inside Trading Channel. Therefore, we would use the Trend-following Indicators like Moving Averages, MACD and ADX to picture our projection.

Typically, the Descending Triangle is a bearish pattern because the Upper Trend closed with a Lower High. This means buyers are less anxious than the sellers, refusing to raise their bids.

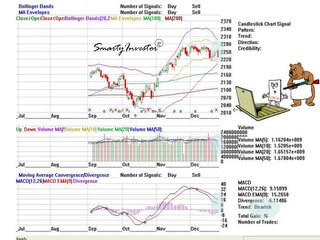

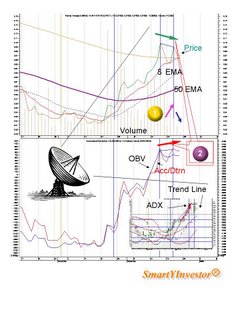

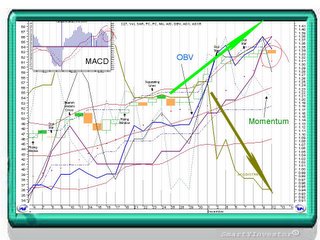

The Breakout of the Triangle occurred on the 29th instant, with heavy Volume. Of course this we know. Thing is, will it holds? So let’s use our selected indicators to test! MA, all cleared, i.e. 8, 13, and 50 EMA... Next, the MACD signals (Chart 3) were also high on the Bullish territory, +ve crossed. Further, ADX (5D) halted its descend and curled up to the strongest trend at 30; screaming for a Buy Signal. I can go along with it, even though I’m aware that the norm ADX is 14 days. Chart 1 shows the bullish 3 White Soldiers marching smartly north! Also,a peek at the ATR is showing a declining trend. To me this means there shall be no problem seeing the Retracement of 50% to 0.75, my envisaged Resistance level.This also approximately coincided with depth of the last Bottom's trough reversed upward, thereby emphasing its significance. Using the base of the Double Bottom as a guide the Support level reads as 0.64. If China Stock is still hot in 2006, this provides window of opportunity, isn’t it?