Chartered (C27) Updated

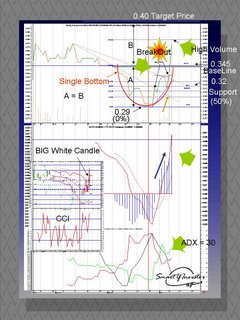

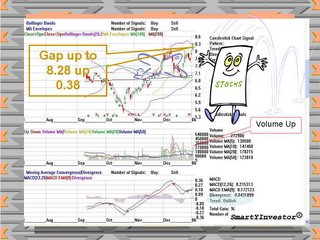

Since my last posting on the 9th instant, the chart had indeed followed the path of the Scenarios 1-2-3 as predicted. Of course in reality, it was not a smooth sailing towards the anticipated TP 0f $1.49. In between a Sine wave was formed. I believed the more nervous one has been wiped out since then. On the big picture a single bottom and a rising wedge were formed. The new support level now is $1.38. We shall see the materialization of the TP soon. Expectedly, we may encounter whipsaws along the way. As I am writing, my other screen showed Chartered USA at US$8.36 down by 0.16. With the breakout on high volume outside the regression channel , a good +ve result and its product highly demanded in the consumer sector, Chatered should perform well!