Monday, October 31, 2005

Saturday, October 29, 2005

Should you let the sleepy lion lie? -The Star Hub!!

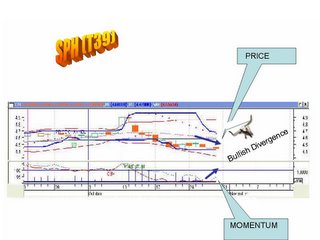

From the big picture, Star Hub already had breached its trend line on 27 Sep 2005. It trended a “down up down” roller coaster ride. Note worthy is the momentum mellowed with every subsequent trend reversal. As no distinctive pattern is observed, we have to device an appropriate technique to unearth its future!. My favourable chart, the regression channel tells quite a future!. 3 current trends were surfaced. Using the current phase, the final black candle was shrinking: denoting the fatigued downtrend, finished off with a mild consolidation (line wise).

While the Willian R % and the Stochastic look worrying, these shortcomings are more than compensated by a high RSI and an impressive MACD envelope sloping towards the zero line. An inevitable positive divergence against the price downtrend; suggestive of an imminent reversal.

Confirming this; the ROC is sloping upward to zero with a good positive gradient. This trend strength indicator tells trend likely to change on upside with larger price moves.

My thumb of rule is the 200MA. My anticipated peak is 85% above! Currently it augured at 17.69% indicative that more upside can be comfortably expected.

Also with an average volume of more than 6 mil during the recent 10 periods, can this liquid stock be let to lie?

Friday, October 28, 2005

Keppel Corporation Analyst Report

Keppel Corporation

Oct 27 close: $11.40

KIM ENG RESEARCH, Oct 26

NET profit for the third quarter came in at $138.7 million, which is just 3 per cent below our forecast of $143.2 million and in line with market expectations. This is a 23 per cent improvement over 3Q04 and a sequential increase of 2.8 per cent. The variance from estimates was due to the recognition policy in the Offshore and Marine division, as it books sales and earnings in different stages from its rig and ship building activities.

Turnover for the O&M division increased by a whopping 52 per cent. Ebitda did not keep pace, and actually declined by 14 per cent sequentially to $83 million. Consequently, margin for O&M plunged from to 7 per cent from 12.2 per cent in the previous quarter. However, management has assured us that this is solely a timing issue, and we expect Ebitda margin to return to the low teens for the full year.

Keppel O&M also is building on its deepwater capabilities, collaborating with J Ray McDermott for new solutions and acquiring patent rights for other designs. This is to take advantage of the robust demand for semi-submersibles which have seen day rates almost double.

Overall, the results provided no surprises. However, we are tweaking our FY05 forecast down marginally, and we now expect net profit of $602.8 million versus $607.4 million previously. This represents 29 per cent growth in net earnings.

Earnings per share at 76.9 cents is slightly ahead of consensus' 74.3 cents. Due to the timing of its profit recognition in the O&M division, Keppel's earnings may be more spread out than currently expected. Ultimately, however, its orderbook of $7.9 billion reinforces the positive outlook for Keppel's three-year earnings horizon, which is what has driven its share price outperformance since the beginning of the year. Our sum of the parts fair value for Keppel Corp remains unchanged at $14.20, and we maintain our 'buy' recommendation.

BUY

Oct 27 close: $11.40

KIM ENG RESEARCH, Oct 26

NET profit for the third quarter came in at $138.7 million, which is just 3 per cent below our forecast of $143.2 million and in line with market expectations. This is a 23 per cent improvement over 3Q04 and a sequential increase of 2.8 per cent. The variance from estimates was due to the recognition policy in the Offshore and Marine division, as it books sales and earnings in different stages from its rig and ship building activities.

Turnover for the O&M division increased by a whopping 52 per cent. Ebitda did not keep pace, and actually declined by 14 per cent sequentially to $83 million. Consequently, margin for O&M plunged from to 7 per cent from 12.2 per cent in the previous quarter. However, management has assured us that this is solely a timing issue, and we expect Ebitda margin to return to the low teens for the full year.

Keppel O&M also is building on its deepwater capabilities, collaborating with J Ray McDermott for new solutions and acquiring patent rights for other designs. This is to take advantage of the robust demand for semi-submersibles which have seen day rates almost double.

Overall, the results provided no surprises. However, we are tweaking our FY05 forecast down marginally, and we now expect net profit of $602.8 million versus $607.4 million previously. This represents 29 per cent growth in net earnings.

Earnings per share at 76.9 cents is slightly ahead of consensus' 74.3 cents. Due to the timing of its profit recognition in the O&M division, Keppel's earnings may be more spread out than currently expected. Ultimately, however, its orderbook of $7.9 billion reinforces the positive outlook for Keppel's three-year earnings horizon, which is what has driven its share price outperformance since the beginning of the year. Our sum of the parts fair value for Keppel Corp remains unchanged at $14.20, and we maintain our 'buy' recommendation.

BUY

ComfortDelGro buys second bus from Shenyang

Singapore

October 28, 2005, 6.25 pm (Singapore time)

ComfortDelGro buys second bus firm in Shenyang

Email this article

Print article

Feedback

COMFORTDELGRO on Friday said it will pay $73.2 million to acquire the operating rights of 50 bus routes, 1,218 buses and other operating assets from Shenyang's largest public bus operator, Shenyang Passenger Transport Group.

The latest bus venture, to be named Shenyang ComfortDelGro Bus Co Ltd, is the land transport giant's second in Shenyang -- the capital of Liaoning province in north-eastern China. The first, Shenyang ComfortDelGro An Yun Bus Company, was set up in 2004.

Together, the two companies will operate 1,763 public buses in the city, making ComfortDelGro the largest operator there with a 40 per cent market share.

Besides bus services, ComfortDelGro also operates taxi services in the city through CityCab(Shenyang) and Shenyang ComfortDelGro Taxi Co.

In September this year, the Singapore-listed company also announced that it had set up a driving school in Chengdu, the capital of Sichuan province.

The school, ComfortDelGro's first outside Singapore, is a $4.8 million joint venture with Chengdu Qing Yang Driving School Co, the Chinese city's largest driving school.

October 28, 2005, 6.25 pm (Singapore time)

ComfortDelGro buys second bus firm in Shenyang

Email this article

Print article

Feedback

COMFORTDELGRO on Friday said it will pay $73.2 million to acquire the operating rights of 50 bus routes, 1,218 buses and other operating assets from Shenyang's largest public bus operator, Shenyang Passenger Transport Group.

The latest bus venture, to be named Shenyang ComfortDelGro Bus Co Ltd, is the land transport giant's second in Shenyang -- the capital of Liaoning province in north-eastern China. The first, Shenyang ComfortDelGro An Yun Bus Company, was set up in 2004.

Together, the two companies will operate 1,763 public buses in the city, making ComfortDelGro the largest operator there with a 40 per cent market share.

Besides bus services, ComfortDelGro also operates taxi services in the city through CityCab(Shenyang) and Shenyang ComfortDelGro Taxi Co.

In September this year, the Singapore-listed company also announced that it had set up a driving school in Chengdu, the capital of Sichuan province.

The school, ComfortDelGro's first outside Singapore, is a $4.8 million joint venture with Chengdu Qing Yang Driving School Co, the Chinese city's largest driving school.

US Economy grows at strong 3.8% rate in Q3

October 28, 2005, 9.20 pm (Singapore time)

US economy grows at strong 3.8% rate in Q3

WASHINGTON - Economic activity expanded at an energetic 3.8 per cent annual rate in the third quarter, providing vivid evidence of the economy's stamina even as it coped with the destructive forces of hurricanes Katrina and Rita.

The latest snapshot of the country's economic performance, released by the Commerce Department on Friday, even marked an improvement from the solid 3.3 per cent pace of growth registered in the second quarter.

Growth in the third quarter was broad-based, reflecting brisk spending by consumers, businesses and government.

The expansion in gross domestic product in the July-to-September quarter, the strongest since the beginning of the year, also exceeded many analysts' expectations. Before the report was released, they were forecasting the economy to clock in at a 3.6 per cent annual rate.

GDP measures the value of all goods and services produced within the United States and is the best barometer of the nation's economic fitness.

Katrina, the costliest natural disaster in US history, struck in late August; Rita hit in late September. Both hurricanes destroyed businesses and homes and choked the flow of trade. They also hobbled essential oil and gas facilities, catapulting energy prices higher and fanning inflation fears.

An inflation gauge tied to the GDP report showed overall inflation picking up in the third quarter. But excluding food and energy prices, 'core' inflation - something the Federal Reserve pays close attention to - actually moderated. Core inflation rose at a rate of 1.3 per cent in the third quarter, down from a 1.7 per cent pace in the second quarter.

Despite the sting of high energy bills, consumers continued to spend, doing their part to keep the economy rolling in the third quarter.

Consumers' boosted spending at a brisk 3.9 per cent rate, the strongest pace since the end of last year. That spending reflected a big appetite for big-ticket 'durable' goods, such as cars, which had been discounted and promoted to lure buyers. Some analysts believe consumer spending probably will moderate, but still remain healthy, in the months ahead.

Businesses increased spending on equipment and software at an 8.9 per cent pace in the third quarter, on top of a 10.9 per cent growth rate in the prior quarter.

Spending by the federal government, which analysts believe included some outlays due to the hurricanes, rose at a 7.7 per cent rate in the third quarter, the fastest pace since the first quarter of 2004.

US economy grows at strong 3.8% rate in Q3

WASHINGTON - Economic activity expanded at an energetic 3.8 per cent annual rate in the third quarter, providing vivid evidence of the economy's stamina even as it coped with the destructive forces of hurricanes Katrina and Rita.

The latest snapshot of the country's economic performance, released by the Commerce Department on Friday, even marked an improvement from the solid 3.3 per cent pace of growth registered in the second quarter.

Growth in the third quarter was broad-based, reflecting brisk spending by consumers, businesses and government.

The expansion in gross domestic product in the July-to-September quarter, the strongest since the beginning of the year, also exceeded many analysts' expectations. Before the report was released, they were forecasting the economy to clock in at a 3.6 per cent annual rate.

GDP measures the value of all goods and services produced within the United States and is the best barometer of the nation's economic fitness.

Katrina, the costliest natural disaster in US history, struck in late August; Rita hit in late September. Both hurricanes destroyed businesses and homes and choked the flow of trade. They also hobbled essential oil and gas facilities, catapulting energy prices higher and fanning inflation fears.

An inflation gauge tied to the GDP report showed overall inflation picking up in the third quarter. But excluding food and energy prices, 'core' inflation - something the Federal Reserve pays close attention to - actually moderated. Core inflation rose at a rate of 1.3 per cent in the third quarter, down from a 1.7 per cent pace in the second quarter.

Despite the sting of high energy bills, consumers continued to spend, doing their part to keep the economy rolling in the third quarter.

Consumers' boosted spending at a brisk 3.9 per cent rate, the strongest pace since the end of last year. That spending reflected a big appetite for big-ticket 'durable' goods, such as cars, which had been discounted and promoted to lure buyers. Some analysts believe consumer spending probably will moderate, but still remain healthy, in the months ahead.

Businesses increased spending on equipment and software at an 8.9 per cent pace in the third quarter, on top of a 10.9 per cent growth rate in the prior quarter.

Spending by the federal government, which analysts believe included some outlays due to the hurricanes, rose at a 7.7 per cent rate in the third quarter, the fastest pace since the first quarter of 2004.

StarHub Analyst Report

SINGAPORE (XFN-ASIA) - Citigroup said it has raised its target price

for

StarHub Ltd to 2.30 sgd from 2.25 due to the company's

better-than-expected three months to September financial results and

quarterly dividends.

Yesterday, StarHub, Singapore's second largest phone firm, said

it

posted net profit of 65.1 mln sgd in the third quarter, reversing a

loss

of 1.4 mln the year before, due to broad-based gains in its phone,

broadband and cable TV segments.

"Its capital management potential stays a powerful 2006 theme.

Assuming target leverage of 1.5-2.0 times net debt/EBITDA, we see

0.33-0.46 sgd per share available for return to shareholders,"

Citigroup

said in a note.

It has maintained a "buy" recommendation on StarHub.

"StarHub stays our preferred telco pick in Singapore and is also

a

top regional telco pick," Citigroup said.

At 2.01 pm, StarHub was up 0.01 sgd, or 0.52 pct at 1.92 with

1.95

mln shares traded.

for

StarHub Ltd to 2.30 sgd from 2.25 due to the company's

better-than-expected three months to September financial results and

quarterly dividends.

Yesterday, StarHub, Singapore's second largest phone firm, said

it

posted net profit of 65.1 mln sgd in the third quarter, reversing a

loss

of 1.4 mln the year before, due to broad-based gains in its phone,

broadband and cable TV segments.

"Its capital management potential stays a powerful 2006 theme.

Assuming target leverage of 1.5-2.0 times net debt/EBITDA, we see

0.33-0.46 sgd per share available for return to shareholders,"

Citigroup

said in a note.

It has maintained a "buy" recommendation on StarHub.

"StarHub stays our preferred telco pick in Singapore and is also

a

top regional telco pick," Citigroup said.

At 2.01 pm, StarHub was up 0.01 sgd, or 0.52 pct at 1.92 with

1.95

mln shares traded.

STI Today!!

As mentioned this morning, today closed at 2192 on the expected range of 2180 and 2220. Still the support level of 2187 is not breached! Let’s see USA tonight and other related key data, then take up for there!

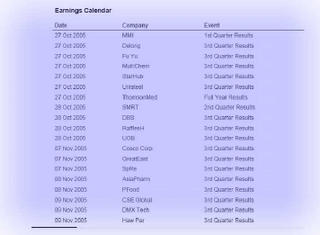

DBS Bank result out

DBS Bank result out under expectation!

SINGAPORE (Dow Jones)--DBS Group Holdings Ltd. (D05.SG) reported a smaller-than-expected 28% rise in third-quarter net profit as higher interest income was offset by a sharp drop in treasury income.

SINGAPORE (Dow Jones)--DBS Group Holdings Ltd. (D05.SG) reported a smaller-than-expected 28% rise in third-quarter net profit as higher interest income was offset by a sharp drop in treasury income.

Important Events for Speedy

Important Events and Dates

Shareholders should note the following important events and dates:

Last day for trading of Shares

: 10 November 2005

Books Closure Date

: 15 November 2005

Election period

: 18 November 2005 to 2 December 2005

Scheme effective date

: 6 December 2005

Expected delisting of Shares

: 20 December 2005

Expected payment of Scheme Price

: 20 December 2005

For events which are listed as “expected”, please refer to future announcement(s) by

the Company and/or the SGX-ST for the exact dates and times of these events.

By Order of the Board

Speedy-Tech Electronics Ltd

Kwok Kai Ming

Director

27 October 2005

Singapore

Shareholders should note the following important events and dates:

Last day for trading of Shares

: 10 November 2005

Books Closure Date

: 15 November 2005

Election period

: 18 November 2005 to 2 December 2005

Scheme effective date

: 6 December 2005

Expected delisting of Shares

: 20 December 2005

Expected payment of Scheme Price

: 20 December 2005

For events which are listed as “expected”, please refer to future announcement(s) by

the Company and/or the SGX-ST for the exact dates and times of these events.

By Order of the Board

Speedy-Tech Electronics Ltd

Kwok Kai Ming

Director

27 October 2005

Singapore

What Merrill Lynch said about SPC

SINGAPORE (XFN-ASIA) - Singapore Petroleum Co Ltd (SPC) may further

ease

after Merrill Lynch cut its profit forecast for the company for this

year

through 2007 after recoverable oil reserves at the firm's Oyong

project

came in lower than expected.

Cue Energy Resources, which holds a 15 pct stake in the Sampang

production sharing contract in which SPC has a 40 pct interest and

Santos

Ltd the other 45 pct, has released its 2005 annual report which

revealed

some negative news regarding the Oyong development project in the

production contract.

Cue said drilling of the Oyong development wells has showed

"unexpected sealing faults that divide the reservoir into several

interpreted fault bounded compartments."

As a result, the contract partners have found that the northern

parts

of the field has oil while the southern part of the field is dry.

Fortunately, the gas column is present in all fault compartments,

which

was as expected.

Merrill Lynch cut its 2005 profit forecast for SPC to 346.7 mln

sgd

from 352 mln previously and for 2006 to 350.4 mln sgd from 378.8 mln

earlier. The profit estimate for 2007 was adjusted to 261.7 mln sgd

from

272.7 mln.

SPC yesterday closed down 0.40 sgd at 4.88.

ease

after Merrill Lynch cut its profit forecast for the company for this

year

through 2007 after recoverable oil reserves at the firm's Oyong

project

came in lower than expected.

Cue Energy Resources, which holds a 15 pct stake in the Sampang

production sharing contract in which SPC has a 40 pct interest and

Santos

Ltd the other 45 pct, has released its 2005 annual report which

revealed

some negative news regarding the Oyong development project in the

production contract.

Cue said drilling of the Oyong development wells has showed

"unexpected sealing faults that divide the reservoir into several

interpreted fault bounded compartments."

As a result, the contract partners have found that the northern

parts

of the field has oil while the southern part of the field is dry.

Fortunately, the gas column is present in all fault compartments,

which

was as expected.

Merrill Lynch cut its 2005 profit forecast for SPC to 346.7 mln

sgd

from 352 mln previously and for 2006 to 350.4 mln sgd from 378.8 mln

earlier. The profit estimate for 2007 was adjusted to 261.7 mln sgd

from

272.7 mln.

SPC yesterday closed down 0.40 sgd at 4.88.

STI today?

With treble digit loss on Wall Street and the poor picture of all STI indicators, in particular the nose-driving RSI, today STI is expected to continue its down trend. It can be envisaged that it will try to test the support level of 2187 . The likely range should be 2180 and 2220. Once the support is broken, bad days ahead; in the short term wise, is imminent!

Thursday, October 27, 2005

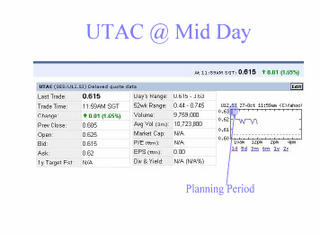

What's next UTAC?

I already warned the weird pattern of UTAC in the past. So don't rush your luck too hard - it's a for "Long Position" only - a long haul game, punter!!

I already warned the weird pattern of UTAC in the past. So don't rush your luck too hard - it's a for "Long Position" only - a long haul game, punter!!My Posting Channel NewsAsia

Posted: Thu Oct 27, 2005 3:00 pm Post subject:

To: Tran on UTAC, Analyst is a guide only- must be taken with a pinch salt. Many had be killed (dead stoned) by them. Also in my blog on 25th Oct 05, CIMB-GK already got wind that 3Q05 would be very good,and assessing on multiper of future earning, rated TP as only 56 cents. Many Analyst contradict. We retail investor must not be confused! My experience tell me that the 4 Ms only matters to me!! Money, Method, Mind & Market Remember, Market is Queen, let her tell you, then goes with her flow. I strongly advocated that UTAC is a very good share, but only for position player!!!

_________________________

Posted: Thu Oct 27, 2005 3:46 pm Post subject:

To: Tran again on UTAC. It was on Aug 2005, the same DBS group targetted UTAC at 84 cents - & buy recommendation of course! Until today they are so clever and never wrong!. It's that you must read in between the lines - Duration is 1 year in their report. We have to be quicker and faster and shaper to survive!. Imagine you buy during that time at peak of 75cents, how old will be your baby now? That's using good money to chase fatigued stock - poor money management in the worst sense. In conclusion, be very careful, resource is rice to Man and ammunication to keep us alive!!

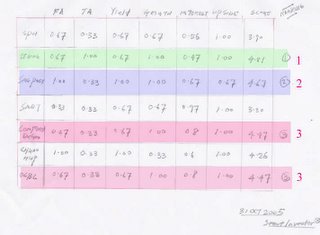

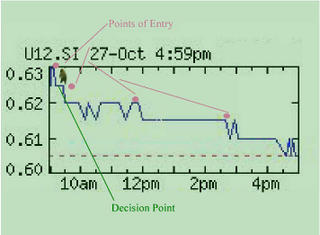

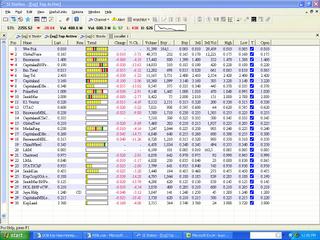

How I would plan my Kill on UTAC if I haven't in a long position before

Good news on UTAC will definitely boost price today. The question is: "Is it right to go in today and at what timing." Many amateurs would be emotionally geared to enter quickly without a proper plan strategy; I refer, particularly to inexperience punter or daytrader. The above is my would be plan!!

Good news on UTAC will definitely boost price today. The question is: "Is it right to go in today and at what timing." Many amateurs would be emotionally geared to enter quickly without a proper plan strategy; I refer, particularly to inexperience punter or daytrader. The above is my would be plan!!

Wednesday, October 26, 2005

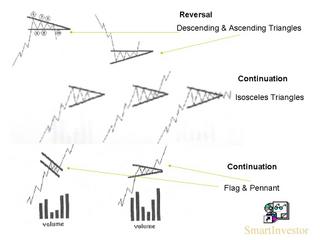

When Time is bad, let's not forget our basic - Buy, Reversal &Continuation Signal

When in bad time, let's take a ride only in a Prefect LTA train!. Don't make mistakes again and again

- Ride on our Profit

- Cut Loss quick

- Trend is friend

- Never Average Losses

and remember all the tools available at all times! Buy only with the odds in your favour! Sound simple, you can bet, it is difficult to implement!!!

SembMarine is a tough nut to crack

SembMarine is a tough nut to crack, Share already fallen considerably (7.7 % this Month), and the selling to institution in mass qty of $2.55 had capped its upside limit. Also in comparison to its peer, Keppel Corp trades less than 3.5times its forecast 2006 earnings. As such SembMarine looks risky and expensive, considering it had rose 165% already for the past 12 month.

Reuter Analyst expect; “net profit of about S$39.6 million ($23.4 million) in the three months to September 30, up 81.7 percent from S$21.8 million in the same period a year ago”. This news already in the market since 9.35 am today. Yet the market was only greeted with a lukewarm response. From experience, this is bearish indication. Of course, for today it may oscillate up and down. Could be more on the upside!!. But be warned. This could be the last dead bounce!!!

Considering the very bearish sentiment on recent periods, and its messy mother, the Semb Corp’s court case and the rumour of more potential mass selling of SembMArine, it is better to be more conservative on this corporation.

I know, oil is going up and their order book can last for many years; even way beyond 2008. But with unclear future to our “very nervous Singapore trader.”, I think it is better to be careful. I shall expect, price to go up but be very prudent !!! The unexpected down swing may explode without further warning in the face of the announced result even though it is a good one. Remember “ Buy on rumour sell on News!

Tuesday, October 25, 2005

STI - Today

So, the STI looked like yesterday, exhibited a downtrend after early rose. It managed to gain 4.13 pt (2222.6). The tail end pattern isn't look good at all with all TA indicators bearish.

With a big gain of DOW and Nasdaq yesterday and yet STI today wasn't impressive at all today ;what could be expected from our market soon? Looking at the bearish USA Futures figures now, I reckon that the party for USA is having a hangover. Thus expecting a give back of some of what DOW/Nasdaq gained yesterday. Folks, look like there are many hard days ahead of us. That is, that we have to endure more pain to see the gain in the future. From, experience ,I would not be surprised that many already so fearful and had quited all positions!!!

DJ S&P - Reit will be Boosted

REIT will be boosted by Singapore New Regulation. Hold tight on to your REIT money making machine!!

STI - Mid day - Neutral position

As yesterday, a shoot up was sighted at 9:10 am topped2252. Similarly, the gain was gradually reduced and stopped mid-day at 2238, a 15.70 gain . At noon, chart looks good with MACD envelope slopping up , RSI and William R% still inclining to a healthy end. Afternoon trading should be bullish, barring any bad news forthcoming. Whether the gain can be sustained is still anybody's guess now!!.

Kim Eng on the Faith of Creative -Sell, Sell, SEll!

SINGAPORE (XFN-ASIA) - Kim Eng Securities said it expects

Creative Technology to report a first quarter to September net loss of 18.50 mln usd on Thursday morning as the consumer electronics maker continues to suffer margin declines in the MP3 player market.

"Excluding about 20 mln usd in inventory write downs in the

Fourth quarter to June, losses would have widened from 12 mln usd (in the previous quarter) as margins continued to decline," Kim Eng Securities analyst Dharmo Soejanto said in a note

He estimated the gross margin to have narrowed by one percentage

point to 15.8 pct in the first quarter to September.

"Its MP3 players are likely to face further margin pressure with

stiffer competition (going forward) , especially as Apple has launched

new players like the iPod Nano."

"Moreover, the launch of the Nano would have led to tightness in

supply for flash memory chips, which are used in many of Creative's

MP3 players," he said.

Soejanto added that there is a risk Creative will continue to

Incur losses even in the usually seasonally strong second quarter to

December as MP3 margins will likely fall by another two percentage points in the current quarter

Kim Eng has a "sell" rating on Creative.

Creative closed yesterday up 0.10 sgd at 12.70 in Singapore. On

Nasdaq overnight, the stock fell 0.10 usd to 7.38.

Creative Technology to report a first quarter to September net loss of 18.50 mln usd on Thursday morning as the consumer electronics maker continues to suffer margin declines in the MP3 player market.

"Excluding about 20 mln usd in inventory write downs in the

Fourth quarter to June, losses would have widened from 12 mln usd (in the previous quarter) as margins continued to decline," Kim Eng Securities analyst Dharmo Soejanto said in a note

He estimated the gross margin to have narrowed by one percentage

point to 15.8 pct in the first quarter to September.

"Its MP3 players are likely to face further margin pressure with

stiffer competition (going forward) , especially as Apple has launched

new players like the iPod Nano."

"Moreover, the launch of the Nano would have led to tightness in

supply for flash memory chips, which are used in many of Creative's

MP3 players," he said.

Soejanto added that there is a risk Creative will continue to

Incur losses even in the usually seasonally strong second quarter to

December as MP3 margins will likely fall by another two percentage points in the current quarter

Kim Eng has a "sell" rating on Creative.

Creative closed yesterday up 0.10 sgd at 12.70 in Singapore. On

Nasdaq overnight, the stock fell 0.10 usd to 7.38.

DJ Market Talk CAUTION on Tech Stock

Rational cited " 4Q05 outlook from US ChipMaker Texas Instrucments likely to tipping scales toward profit taking".

OCBC Investment's Advice

The Dow Jones Industrial Average rebounded last night, the STI should start off with a strong trading session, recommend to close off long position if there is any.

STI -Likely to be UP!

Against the backdrop of high DOW and Nasdaq, STI likely to be boosted. Ranging 2230 to 2260. Tech stock can be expected to continue its gain!!

Singapore Keppel Land (K02) 's 3 Q result 2.5% rise

But this is less than what Analyst expected. So, with such a nervous market like Singapore, you can imagine what will happen to Keppel Land on tomorrow's openning!!!

Any "short" taker???

Any "short" taker???

Monday, October 24, 2005

STI Today

At 9.00am today, the STI grazed near my predicted resistance level of 2254. The 2250 level was however not sustained. Quickly it declined and went under ending minus 16.53 point (2222.83) .. Noteworthy fact was the D-ve went above D+ve with a threatening decline endeavour. Also ADX sloped upward signified an added trend on the declining end. Whether today's STI fall will spill over tomorrow is anybody's guess!!!. Of course, not forgetting the Dow and Nasdaq on the Macro background. While I am writing , Dow is 91 pt and Nasdaq 12 pt up simultaneously.

My previous posting on the Tech sector prediction based on Dow and Nasdaq divergence came in accurately today. Perhaps, another impetus of the day was the DBS Group’s upgrading of Chartered” from hold to buy” in the morning. Chartered, StatsChip and UTAC rallied in tandem.

What ever will happen will happen!!!. Still watching USA’s trading now. Image of tomorrow can only be conjured by tomorrow morning; with all the USA situation then concreted.

Sunday, October 23, 2005

Rules from:Methods of a Wallstreet Master - Sperandeo

- Trade with a plan

- Trade with the trend. “The trend is your friend!”

- Use stop loss orders whenever practical

- When in doubt, get out!

- Be patient. Never overtrade.

- Let your profit run; cut your losses short.

- Never let a profit run into loss.

- Buy weakness and sell strength. Be just as willing to sell as you are to buy.

- Be an investor in the early stages of bull markets. Be a speculator in the latter stages of the bull markets and in bear markets.

- Never average a loss- don’t add to a losing position.

- Never buy just because the price is low. Never sell just because the price is high.

- Trade only in liquid markets.

- Never initiate a position in a fast market.

- Don’t trade on the basis of “tips”. In other words, “trade with the trend, not your friend”. Also, no matter how strongly you feel about a stock or other market, don’t offer unsolicited tips, or advice.

- Always analyse your mistakes.

- Beware of “TakeOvers.”

- Never trade if your success depends on a other's good execution.

- Always keep your own records of trades.

- Know and follow the Rules!.

STI - Where are YOU!

Currently formed a downtrend regression channel which seemed bearish in short term. Good news is that the severeness reduced; an indication of exhaustion and indecision. From the downtrend channel, the resistance and support level is 2,254 and 2,183 respectively. The bull can only wake up after this 2,254 level.

Saturday, October 22, 2005

Friday, October 21, 2005

DBSGroup's Earning to Surge

Thu, 20 Oct 2005 15:34:24 +0800

SINGAPORE (XFN-ASIA) - Goldman Sachs said it expects DBS Group's

earnings

to surge in the next two years on the back of rising interest rates

and

demand for home mortgage financing.

While DBS's net profit will likely dip to 1.83 bln sgd this year

from

2. 02 bln last year, Goldman said the bank's net profit should rise to

2.15 bln in 2006 and to 2.40 bln in 2007.

"We expect margins to track up in the fourth quarter and in 2006

on

rising Singapore interbank rates and better mortgage pricing in

Singapore," Goldman said, adding that DBS is the most exposed to the

interbank market among local banks.

Given its lower loans to deposit ratio among Singapore banks, DBS

should also benefit from rising property demand, it said.

Goldman reaffirmed its "buy" rating for DBS as it believes the

bank's

stock is grossly undervalued vis-a-vis Goldman's fair value of 18.50

sgd

per share.

"The current valuation is unjustified especially given that DBS's

core return on equity has been steadily rising," Goldman said.

DBS ended the morning session up 0.10 sgd or 0.64 pct at 15.80

with

1.73 mln shares traded.

CIMB-GK Research gave UTAC "neutral" rating TP $0.56

Thu, 20 Oct 2005 16:37:05 +0800

SINGAPORE (XFN-ASIA) - CIMB-GK Research gave United Test and Assembly

Corp

(UTAC) a "neutral" rating in its initial coverage of the stock as the

market has largely priced in a recovery for the semiconductor

industry.

The brokerage firm also said high oil prices could affect

longer-term demand for semiconductors.

"We have a target price of 0.56 sgd based on 12 times 2006 PE.

This compares with the average of 10 times 2006 PE for its global peers. We

are according a 20 pct premium to UTAC because it has a 40 pct exposure to

the less-volatile mixed-signal and logic processor market, compared with

the more volatile memory industry which its Taiwanese peers serve," CIMB

said in a client note.

"We believe its share price levels have priced in its potential.

We believe a 20 pct premium is fair for UTAC."

At 12.08 pm, UTAC was up 0.015 sgd or 2.6 pct at 0.60 on volume

of 6.244 mln shares.

SINGAPORE (XFN-ASIA) - CIMB-GK Research gave United Test and Assembly

Corp

(UTAC) a "neutral" rating in its initial coverage of the stock as the

market has largely priced in a recovery for the semiconductor

industry.

The brokerage firm also said high oil prices could affect

longer-term demand for semiconductors.

"We have a target price of 0.56 sgd based on 12 times 2006 PE.

This compares with the average of 10 times 2006 PE for its global peers. We

are according a 20 pct premium to UTAC because it has a 40 pct exposure to

the less-volatile mixed-signal and logic processor market, compared with

the more volatile memory industry which its Taiwanese peers serve," CIMB

said in a client note.

"We believe its share price levels have priced in its potential.

We believe a 20 pct premium is fair for UTAC."

At 12.08 pm, UTAC was up 0.015 sgd or 2.6 pct at 0.60 on volume

of 6.244 mln shares.

News on Chartered Semiconductor

Fri, 21 Oct 2005 14:14:58 +0800

SINGAPORE (AFX) - Chartered Semiconductor Manufacturing Ltd's shares

recovered from the sharp losses seen earlier this week after its

surprised the market by posting smaller losses in the third quarter and

predicted a return to profitability in the fourth quarter, analysts said. At 2.10

pm, Chartered was up 0.05 sgd or 5.26 pct at 1.00, off a high of 1.01,

with 11.15 mln shares traded The Straits Times index was up 5.68 points at

2,232.56 Chartered posted third-quarter net loss of of 34.51 mln usd,

narrower than the 67 mln loss in the second quarter as sales grew

faster than expected, aided by strong demand for chips in the gaming console

market, particularly from Xbox. The loss for the September quarter was

smaller than the company's projected loss of 42-52 mln usd. In the

same quarter last year, Chartered made a net profit of 16.23 mln usd. Sales

jumped to 290.13 mln usd in the third quarter from 257.28 mln a year

ago. Chartered had forecast third-quarter sales at 279-287 mln usd.

Chartered expects sales to grow 22-25 pct quarter-on-quarter to 355-363 mln usd

in the last quarter of the year, allowing it to achieve a net profit of

5-15 mln usd. The company will still report a net loss of about

171.13-181.13 mln usd for the whole of 2005 should it achieve its forecast profit in

the fourth quarter but for 2006, analysts believe Chartered will be

profitable. An analyst with a European brokerage expects Chartered to

post a 50 mln usd net profit in 2006, which he believes is at the lower end

of most analysts' forecasts. "In general the second half of 2005 should

not be a problem for the semiconductor industry. The key is the 2006

outlook," he said. Demand for leading-edge chips, such as 90-nanometer chips,

should remain firm next year, but it remains to be seen by how much

Chartered's earnings will improve. He noted that Chartered's breakeven capacity

utilization level of 75 pct is still high compared to the 55 pct

breakeven level of industry leader Taiwan Semiconductor Manufacturing Corp. The

analyst said he is keeping his "reduce" rating on Chartered. He will,

however, look to accumulate the stock around 0.90 sgd. OCBC Securities

analyst Bryan Yeong said he is keeping his "hold" recommendation on

Chartered Semiconductor as he does not see much upside for the stock.

His fair value estimate for the stock is about 1.09-1.10 sgd. Yeong said

demand for chips from Xbox boosted Chartered's sales in the third

quarter and will continue to push up earnings in the fourth quarter. However,

he said it remains to be seen whether earnings will continue to

strengthen nto 2006. OCBC forecasts that Chartered will make a net profit of 32

mln usd next year but Yeong reckons that earnings could easily swing into

losses if demand for chips dip. "Rising interest rates is also a

concern,"

Yeong said, noting that Chartered expects to pay 60 mln usd in

interest

charges next year. (1 usd = 1.69 sgd) singapore@xfn.com jb/mas

SINGAPORE (AFX) - Chartered Semiconductor Manufacturing Ltd's shares

recovered from the sharp losses seen earlier this week after its

surprised the market by posting smaller losses in the third quarter and

predicted a return to profitability in the fourth quarter, analysts said. At 2.10

pm, Chartered was up 0.05 sgd or 5.26 pct at 1.00, off a high of 1.01,

with 11.15 mln shares traded The Straits Times index was up 5.68 points at

2,232.56 Chartered posted third-quarter net loss of of 34.51 mln usd,

narrower than the 67 mln loss in the second quarter as sales grew

faster than expected, aided by strong demand for chips in the gaming console

market, particularly from Xbox. The loss for the September quarter was

smaller than the company's projected loss of 42-52 mln usd. In the

same quarter last year, Chartered made a net profit of 16.23 mln usd. Sales

jumped to 290.13 mln usd in the third quarter from 257.28 mln a year

ago. Chartered had forecast third-quarter sales at 279-287 mln usd.

Chartered expects sales to grow 22-25 pct quarter-on-quarter to 355-363 mln usd

in the last quarter of the year, allowing it to achieve a net profit of

5-15 mln usd. The company will still report a net loss of about

171.13-181.13 mln usd for the whole of 2005 should it achieve its forecast profit in

the fourth quarter but for 2006, analysts believe Chartered will be

profitable. An analyst with a European brokerage expects Chartered to

post a 50 mln usd net profit in 2006, which he believes is at the lower end

of most analysts' forecasts. "In general the second half of 2005 should

not be a problem for the semiconductor industry. The key is the 2006

outlook," he said. Demand for leading-edge chips, such as 90-nanometer chips,

should remain firm next year, but it remains to be seen by how much

Chartered's earnings will improve. He noted that Chartered's breakeven capacity

utilization level of 75 pct is still high compared to the 55 pct

breakeven level of industry leader Taiwan Semiconductor Manufacturing Corp. The

analyst said he is keeping his "reduce" rating on Chartered. He will,

however, look to accumulate the stock around 0.90 sgd. OCBC Securities

analyst Bryan Yeong said he is keeping his "hold" recommendation on

Chartered Semiconductor as he does not see much upside for the stock.

His fair value estimate for the stock is about 1.09-1.10 sgd. Yeong said

demand for chips from Xbox boosted Chartered's sales in the third

quarter and will continue to push up earnings in the fourth quarter. However,

he said it remains to be seen whether earnings will continue to

strengthen nto 2006. OCBC forecasts that Chartered will make a net profit of 32

mln usd next year but Yeong reckons that earnings could easily swing into

losses if demand for chips dip. "Rising interest rates is also a

concern,"

Yeong said, noting that Chartered expects to pay 60 mln usd in

interest

charges next year. (1 usd = 1.69 sgd) singapore@xfn.com jb/mas

SembCorp Marine (S51) the ODD amongst the Crowd

Notice and observe something strange on this stock. Most opportunists would have captalising on the sell down of the so called D day on the 19th($2.81) and make entry on 20th, the next day in hope of gain from rebound. Price also dropped a lot already before (as in chart above) and S51 was in very oversold state. But instead the next day price went up in the early morning brisky to $2.86 and ended with very heavy selling pressure. Assuming that Day Trader went in at $2.85 - in the the heat of accelerating time, had to exit @ $2.77 prior to its close @ $2.76; nursing a huge loss on a single day. Today ended in shadowed doji/hammer. Shall keep a watch and seem better to ride on its uptrend rather than vice visa!

Chuan Hup -What next? - Low , low, how low can you go??

Today intraday chart looked bullish at tail end and like it can't go low for long period.

Talking about Chuan Hup, as I predicted there will be a drop after XD of dividend. But not so much. Expecting price to stablise these few days. After which it will rise again when more concrete announcement of the special dividend of 44 cents is announced. This is easily anticipated and expected. What then after XD of the 44 cents. Surely price of good old Chuan Hup cannot be less than 40cents, assuming not much rise from now to collection of special dividend. So the clever trader would have to capitalise on this imbalance of prices in between these periods.- The win and lose ball game is dependant of the TIMING of entry and exit!!!

Thursday, October 20, 2005

BEAR TRAP -A Call to have a BREAK!!!!

Market today is definitely a BEAR trap. As always, Oct is a Killer Month. Looking at today's market and its volume and monitoring a few stocks closely, I think, I can save myself a lot of $$$$ by avoiding the MARKET for this Month!!! So Long, Folks

Wednesday, October 19, 2005

STI - 3 Months low

Shivered by Wall Strait overnight falls STI today recorded lowest since early July. STI down 66.03 points (2.99%) to 2218.13

Dow Jones Newswires pointed the villian as USA interest rate Fear. Nearly all Asian stock nose dived in tandem

Dow Jones Newswires pointed the villian as USA interest rate Fear. Nearly all Asian stock nose dived in tandem