STI - Today

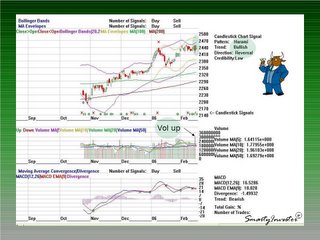

Today STI strikes my forcasted lottery (2490)on the 15th Jan Last Posting on STI 15-Jan-2006 Although the timing is delayed, the concept is acheived,(Intraday STI 2462 - 2490 )

Today STI strikes my forcasted lottery (2490)on the 15th Jan Last Posting on STI 15-Jan-2006 Although the timing is delayed, the concept is acheived,(Intraday STI 2462 - 2490 )Tomorrow, Newspapers will have STI recorded highest within 6 years? But what does this means to the retail traders like us. Very choppy session seriously down in the morning; piggy backed Japan's fall and crept up in the afternoon. China plays (except for a few stocks) , down nerviously. Gainers were the banks, with the except of OCBC, downed by 5 cents, even with good results. Perhaps 12 cents dividend is not enough.