Comfort Delgro (C52) as requested

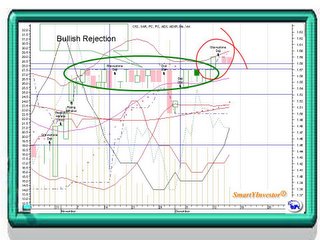

Let’s light a Candle and look into this TAXI! Since mid Nov 2005, the resistance of $1.57 was tested 17 times. Also in the Candlestick language, the so called “Bullish Rejections” occurred. Notice most of the candles have their heads knocking the ceiling with most of them having little tails called “springs”. This has a bullish implication as buying activity has been occurring at this same price level. Surely, it has to break through and it happened on the 12 Dec 2005. But after that sad story happened! A Gravestone Doji surfaced. Since Doji was derived from Japanese word for “feudal lord”, you know surely what they will do, if Graveyard was mentioned? Followed by a thrust (top wicked) black candle and then a shaven black candle. All these would be expected to be heavy on the $1.58 support level. Probability of sinking will be high, right?

OBV flat and Accumulation/Distribution down. RSI stayed neutral at 58. So was the Williams’ R % but flat at -40. These indicators are taking a neutral stand

The bad ones are the MACD histogram with sloping envelope and the frightening Stochastic smashing down, negatively crossed from the overbought zone. These are bearish clues. Also very low Volume today is indicative of total lack of interest from the buyer side.

ADX with its favorable placed D+ and MACD signals uncrossed would certainly provide some muting of these short term bearish environment.

On balance, a very overbought and bad short term can be probably expected. So currently, it looks like it going sideways, and if you are the very patient type of trader, you may still benefit, (Warren Buffet’s style.) What long long!

0 Comments:

Post a Comment

<< Home