SMRT - Strike while the Iron is Hot?

Quarterly Momentum has been flat, but Quarterly ROC Zig Zag ( small up-down-up) ended at 55. This should be resolved into the upside.

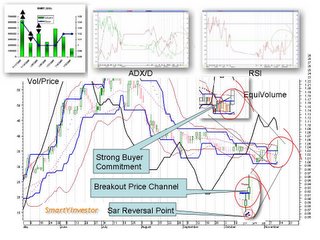

Short term wise, the previous 2 non-synced Volume/Price pattern was finally changed. Today the Volume rose in concert with the Price. A sign that there was more buying for the stock than there was selling. This commitment by buyers in an uptrend mood was evidenced in the EquiVolume chart as shown. The SAR reversal pattern, together with a breakout by the White Candle bombarding the top Price Channel, added convictions. Techncially,RSI was up and at 58 and D just turned positively placed with ADX eased - meaning uptrend is going to be strong. Interest exhibited strength relatively: Today’s 6.35 mil volume was almost doubling the last 10 period average of 3.3 mil.

Upside potential looks pretty good as SMRT is currently only 0.5% above the 200 MA

Based on the Price Channel Theory, current Support is $1.00 and Resistance is $1.03. Today’s $1.04 already cleared this Resistance level. Also today’s High of $1.60 is telling us that a TP of $1.14 can be envisaged. After all, this is just in the middle of the magic Fibonacci Retracement (50% - 61.8%).

0 Comments:

Post a Comment

<< Home