Sph update

So the result is out. If read between the lines, the operating profit is better than previous year. Quoted from SPH :"Profit from Operations for the Full Year up 12.7% to $380.8 million". Only dragged down by the so called exceptional items/expense:

Oct 11 Reuter

Singapore Press 2005 net profit down 9.4 pct

Oct 11 (Reuters) - Year to August 31, 2005

(in millions of S$ unless stated)

2005 2004

Operating profit/(loss) 380.79 vs 337.95

Exceptional items (38.54) vs (28.68)

Pre-tax profit/(loss) 564.74 vs 600.19

Net profit/(loss) 494.69 vs 546.28

Group shr (cents) 0.31 vs 0.31

Turnover 1,007.51 vs 970.08

Final dividend (cents) 10.00 vs 10.00

Special dividend (cents) 7.80 vs 11.25

Also SPH is considering selling the paragon when the price is right.

Quoted: "Ex-Chairman Lim Chin Beng said the group has received interest from various parties for Paragon and it was still evaluating offers. Lim added that the group was open to all possibilities, including a real estate investment trust (REIT)"

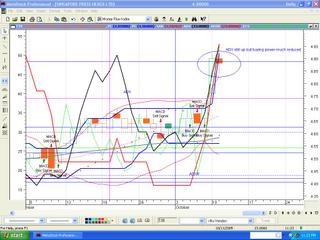

From the chart above, I should be ready to abandon, if an "evening star" candle is emerging. In trading, the 3 so called essential considerations (Risk/reward,Outcome & Timewise)are relative to different traders i.e long haul or short one. My strategy for SPH is the hit and run, so I shall run on above scenario and ride on it if the trade turned bullish.

Be alert tommorrow and take action via what the market tell us

0 Comments:

Post a Comment

<< Home